Bendigo Bank, Auswide Bank, MyState Bank, and ING are the latest banks to move on their home loan rates, following the Reserve Bank’s decision to lift the cash rate by 0.25% on Tuesday.

Bendigo Bank home loan customers on a variable rate loan will see their interest rate rise by 0.25% p.a. by March 17.

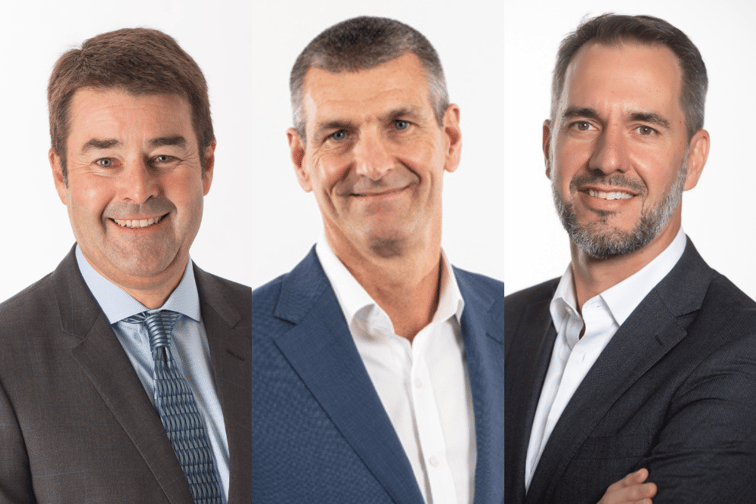

“We understand the RBA’s decision to lift rates on Tuesday will put increased pressure on borrowers and their budgets,” said Richard Fennell (pictured above left), chief customer officer for consumer banking. “At Bendigo Bank, we have a team standing by to help customers with any concerns they may have. I urge those looking for a better interest rate to take a look at Bendigo Bank’s Home Loan Health Check to make sure your current home loan meets your needs.”

From March 16, Auswide Bank’s interest rates on existing variable rate home, business, and personal loans will lift by 0.25% pa, while rates available to new borrowers will also increase by 0.25% to 0.3% pa, depending on the applicable LVR.

Martin Barrett (pictured above center), Auswide Bank managing director, said the bank continued to support any customers in response to the ongoing hikes.

“Concerns of mortgage stress are not our experience to date and we are sitting at record low arrears. Nonetheless we remain vigilant and want to support any customers who may need support,” Barrett said.

Effective March 20, MyState Bank variable home loan interest rate will increase by 25 basis points.

Brett Morgan (pictured above right), MyState Bank managing director and CEO, noted that the bank’s home loan customers are largely holding steady in the face of the 10 consecutive rises.

“Around one in three are around six months or more ahead in their repayments,” Morgan said. “But this of course is not the case for everyone with the RBA rate rises coupled together with the cost-of-living pressures creating a challenge for many household budgets. I encourage anyone who is concerned about how they will meet their repayments to talk to their bank. We are here to listen to you and to help you.”

ING said it will also pass the RBA hike in full to all variable home loan rates for new and existing customers, starting March 14.

Have a thought about these rate hikes? Include it in the comments below.